Offshore Trust and Foundation Incorporation

Offshore Trust

A trust is a relationship whereby property (real or personal, tangible or intangible) is held by one party for the benefit of another. A trust conventionally arises when property is transferred by one party to be held by another party for the benefit of a third party, although it is also possible for a legal owner to create a trust of property without transferring it to anyone else, simply by declaring that the property will henceforth be held for the benefit of the beneficiary. A trust is created by a settlor, who transfers some or all of his property to a trustee, who holds that trust property (also called the principal or corpus) for the benefit of the beneficiaries.

After the trust is engaged, the trustee is the property manager, has a duty to be a good administrator with a faithful manner to manage the property in accordance with the provisions of the trust and law. As the role of the trustee is a administrator of the trust property, it is difficult for the third parties to know the real identifications of the clients. Consequently, the trust is standing with high confidentiality. Moreover, a will can usually be replaced by a trust in order to avoid the public disclosure in the pre-determined will process. Therefore, the trust has become a tool for the arrangements of the inheritance and the estate planning to future generations and is the preferred option to reduce the taxation.

An offshore trust is simply a conventional trust that is formed under the laws of an offshore jurisdiction.

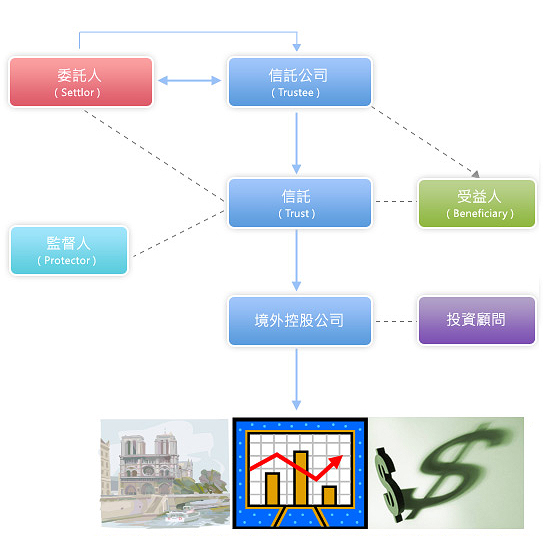

The general structure of a trust is stated as below :

Offshore Foundation

Foundation is defined by the donors (Founder) contributions a certain properties or assets to an established organization, the operations and activities of the organization are managed based the wishes of donors. In Taiwan, the main objective of Foundation is to for charity, however, in foreign countries, the functions of the foundation could be for the personal asset planning. It could be named as a Private Interest Foundation. If the Foundation was set up in foreign countries, it is called offshore foundations.

Overseas Foundation is similar with the offshore trust, but there are few characters are different, as below:

➢ foundation is a legal entity established in accordance with the law, but the trust established is based on the client's intent and is a contractual behavior only.

➢ after the founders transfer the assets to the Foundation, the transfer cannot be canceled and the assets will no longer be owned by contributors.

➢ donors or other person may donate the assets to the Foundation again anytime.

➢ the benefits or interests will be allocated to the designated beneficiaries in according to the charters of the foundations or the intents of founders.

An offshore foundation, the founders could be individuals or companies and the purpose may be for tax savings, asset protection, real estate investment or management, company pension plans and other employee compensation. We can provide further services if you have interest.

Overseas Foundation is similar with the offshore trust, but there are few characters are different, as below:

➢ foundation is a legal entity established in accordance with the law, but the trust established is based on the client's intent and is a contractual behavior only.

➢ after the founders transfer the assets to the Foundation, the transfer cannot be canceled and the assets will no longer be owned by contributors.

➢ donors or other person may donate the assets to the Foundation again anytime.

➢ the benefits or interests will be allocated to the designated beneficiaries in according to the charters of the foundations or the intents of founders.

An offshore foundation, the founders could be individuals or companies and the purpose may be for tax savings, asset protection, real estate investment or management, company pension plans and other employee compensation. We can provide further services if you have interest.